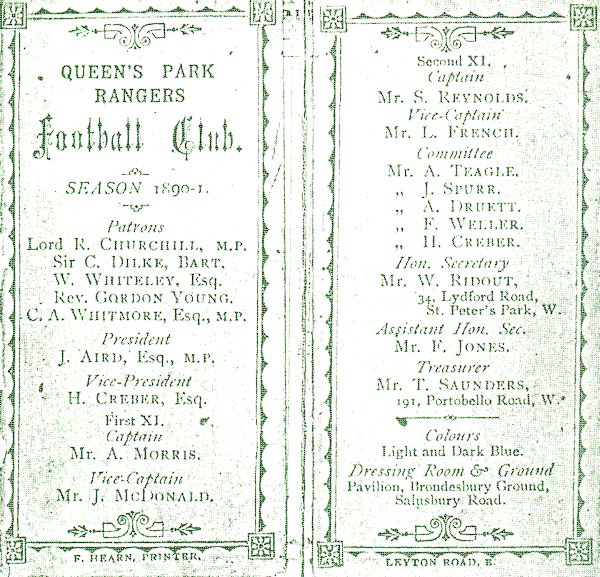

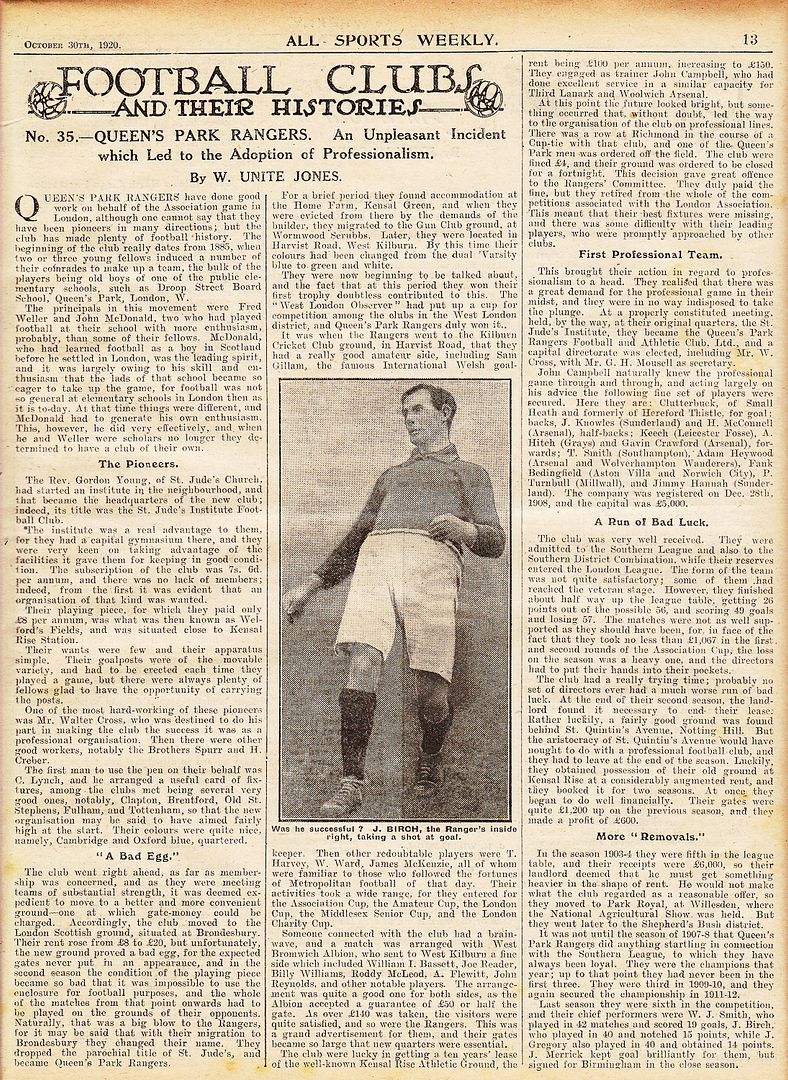

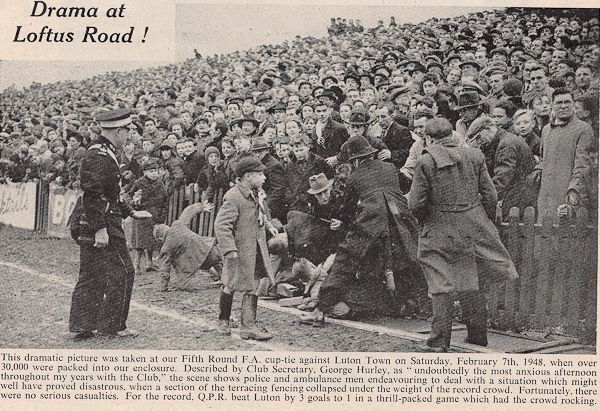

- MOre from the Bushman Archives re the Early Days

- QPR Flashback: On This Day for QPR (May 31) - 2,3,4,5,6, even 12 Years ago!

- Brentford Q and A With Brentford CEO (and ex-QPR CEO) Mark Devlin including re QPR

- Renewed Samba Interest?

- Holocaust Survivor Talking to England Team...Avram Grant's Annual Return to Auschwitz

- Euro 2012: Poland and Ukraine hit back at racism accusations

- Euro 2012: Mario Balotelli threatens to 'kill' banana-throwing fans

Dave McIntyre/West London Sport - QPR make improvements to training ground

QPR are relaying the main pitch at their training ground as part of several improvements to the Harlington facility ahead of next season.

Rangers expect next term to be their last at the site near Heathrow Airport, as the club plan to move to a new training ground near Osterley Park in time for the start of the 2013-14 campaign.

A players' tunnel has been added at Harlington.

In the meantime, manager Mark Hughes is keen to make a number of changes at his team's current base, including the upgrading of gym equipment.

A tunnel linking the gym and changing rooms to the training field was also recently erected.

Obviously there are plans for a new training ground, but before that happens there are a number of things we can do,Hughes explained.

think everybody understands that the current situation isnt ideal. But as long as the pitch is in good enough condition and we can carry out our work then were happy.

There were things I felt werent quite right when I came here and its really a question of getting to work and making improvements in the correct areas.

I know the place well as it was Chelseas training ground when I played there. Not too much has changed but there are things we can do pretty quickly.http://www.westlondonsport.com/qpr/qpr-make-improvements-to-training-ground/

QPR are relaying the main pitch at their training ground as part of several improvements to the Harlington facility ahead of next season.

Rangers expect next term to be their last at the site near Heathrow Airport, as the club plan to move to a new training ground near Osterley Park in time for the start of the 2013-14 campaign.

A players' tunnel has been added at Harlington.

In the meantime, manager Mark Hughes is keen to make a number of changes at his team's current base, including the upgrading of gym equipment.

A tunnel linking the gym and changing rooms to the training field was also recently erected.

Obviously there are plans for a new training ground, but before that happens there are a number of things we can do,Hughes explained.

think everybody understands that the current situation isnt ideal. But as long as the pitch is in good enough condition and we can carry out our work then were happy.

There were things I felt werent quite right when I came here and its really a question of getting to work and making improvements in the correct areas.

I know the place well as it was Chelseas training ground when I played there. Not too much has changed but there are things we can do pretty quickly.http://www.westlondonsport.com/qpr/qpr-make-improvements-to-training-ground/

FOOTBALL FINANCES - DELOITTE's ANNUAL REPORT

Guardian/Press Association

Deloitte survey finds Premier League player wages have hit record high

• Wages went up to almost £1.6bn in 2010-11

• Increase outstripped the growth in revenues

Share 1

The rise in player wages has reached record levels in the Premier League – a worrying trend with clubs now subject to Uefa's financial fair play rules.

The latest annual review of football finance by Deloitte shows the increase in wages outstripped the growth in revenues.

It has resulted in a wages/revenue ratio of 70% in the Premier League – a record figure having crept up from the low- to mid-60s five years ago.

Wages went up by £201m in 2010-11 to almost £1.6bn, a 14% rise, and overall revenues rose by 12% to £2.27bn. This was mostly driven by a rise in income from the new TV deals, especially from overseas rights.

Alan Switzer, the director in the sports business group at the analyst Deloitte, said wage control was paramount for good business.

He said: "If the wages to revenue ratio is 70% or higher it's very difficult to make an operating profit.

"In our view it is too high as a league and the clubs need to be edging back to the low 60s. Every 1% that it drops should increase operating profits by £20m to £25m."

The wage rises at some of the bigger clubs have been offset by significant rises in commercial income at some sides, including Manchester United, Liverpool and Manchester City.

The figures are for the 2010-11 season so are the last ones before Uefa starts taking them into account for its financial fair play (FFP) calculations where clubs in European competition have to break even.

Switzer said Manchester City and Chelsea faced the greatest challenges in conforming to the FFP rules.

"Chelsea and Manchester City are the clubs which have recorded the biggest losses so they are the two which have the most to do, and to be fair to them they have been pretty public about needing to take action," he added.

"A significant number of clubs around Europe have some distance to travel on the road towards compliance."

The Deloitte report does not cover the most recent season, but it does show the effect of the 50% tax band coming into play – the 92 league clubs paid nearly £1.2bn in tax, up 20%.

The report also shows almost half of top-flight clubs had a reduction in match day revenue reflecting the fact that many have been cautious about raising ticket prices during the current economic climate.

Other points highlighted by the report include:

• Combined pre-tax losses among Premier League clubs were £380m, while transfer spending increased by £210m (38%), to a record level of £769m.

• Total revenue in the Championship increased by £17m (4%) to £423m, partly caused by an increase in the solidarity payments from the Premier League.

• The wages/revenue ratio in Championship clubs was an even-more worrying figure of 90%.

• The Bundesliga remained Europe's most profitable league with operating profits of £154m, a 24% increase. In the Premier League, overall operating profits decreased by £16m to £68m.

• Net debt in Premier League clubs fell by £351m (13%) to £2.4bn, the lowest level since 2006. Of that, 62% (£1.5bn) is in non-interest bearing "soft loans", most of which relates to three clubs: Chelsea (£819m), Newcastle (£277m) and Fulham (£200m). Guardian

Deloitte survey finds Premier League player wages have hit record high

• Wages went up to almost £1.6bn in 2010-11

• Increase outstripped the growth in revenues

Share 1

The rise in player wages has reached record levels in the Premier League – a worrying trend with clubs now subject to Uefa's financial fair play rules.

The latest annual review of football finance by Deloitte shows the increase in wages outstripped the growth in revenues.

It has resulted in a wages/revenue ratio of 70% in the Premier League – a record figure having crept up from the low- to mid-60s five years ago.

Wages went up by £201m in 2010-11 to almost £1.6bn, a 14% rise, and overall revenues rose by 12% to £2.27bn. This was mostly driven by a rise in income from the new TV deals, especially from overseas rights.

Alan Switzer, the director in the sports business group at the analyst Deloitte, said wage control was paramount for good business.

He said: "If the wages to revenue ratio is 70% or higher it's very difficult to make an operating profit.

"In our view it is too high as a league and the clubs need to be edging back to the low 60s. Every 1% that it drops should increase operating profits by £20m to £25m."

The wage rises at some of the bigger clubs have been offset by significant rises in commercial income at some sides, including Manchester United, Liverpool and Manchester City.

The figures are for the 2010-11 season so are the last ones before Uefa starts taking them into account for its financial fair play (FFP) calculations where clubs in European competition have to break even.

Switzer said Manchester City and Chelsea faced the greatest challenges in conforming to the FFP rules.

"Chelsea and Manchester City are the clubs which have recorded the biggest losses so they are the two which have the most to do, and to be fair to them they have been pretty public about needing to take action," he added.

"A significant number of clubs around Europe have some distance to travel on the road towards compliance."

The Deloitte report does not cover the most recent season, but it does show the effect of the 50% tax band coming into play – the 92 league clubs paid nearly £1.2bn in tax, up 20%.

The report also shows almost half of top-flight clubs had a reduction in match day revenue reflecting the fact that many have been cautious about raising ticket prices during the current economic climate.

Other points highlighted by the report include:

• Combined pre-tax losses among Premier League clubs were £380m, while transfer spending increased by £210m (38%), to a record level of £769m.

• Total revenue in the Championship increased by £17m (4%) to £423m, partly caused by an increase in the solidarity payments from the Premier League.

• The wages/revenue ratio in Championship clubs was an even-more worrying figure of 90%.

• The Bundesliga remained Europe's most profitable league with operating profits of £154m, a 24% increase. In the Premier League, overall operating profits decreased by £16m to £68m.

• Net debt in Premier League clubs fell by £351m (13%) to £2.4bn, the lowest level since 2006. Of that, 62% (£1.5bn) is in non-interest bearing "soft loans", most of which relates to three clubs: Chelsea (£819m), Newcastle (£277m) and Fulham (£200m). Guardian

THE STAR -PREMIER LEAGUE FOOTBALL HEROES PLUNDER PREMIER’S £2BN JACKPOT

31st May 2012 By Steve Hughes

THE Premier League has stuck two fingers up at the recession by raking in monster revenues of £2.3billion.

A record 70% of that cash was spent on millionaire players’ wages.

And four clubs in the top division, including champions Manchester City, spent more than 100% of their revenue on their wage bill.

Just five years ago the average wages-to-revenue ratio was around 60%.

The figures, which appear in the latest annual review of football finance by analyst Deloitte, show that players are raking it in more than ever before.

Wages went up by £201million in 2010/11 to almost £1.6bn, a 14% rise.

Overall revenues rose by 12% to £2.27bn.

Manchester United and England striker Wayne Rooney, 26, leads the way in wages, raking in £250,000 a week.

Manchester City stars Yaya Touré, 29, and Carlos Tévez, 28, are not far behind, earning £220,000 and £200,000 a week respectively.

Chelsea’s John Terry, 31, and Frank Lampard, 33, also enjoy massive salaries, trousering weekly pay packets of £150,000 and £140,000.

Despite Rooney’s bumper pay packet, the team with the lowest wages/revenue ratio was Manchester United, who spend 46% of revenue on paying players.

Other top-flight clubs that fall below the 70% mark include Tottenham Hotspur, Newcastle United and Arsenal.

Swansea, QPR, Aston Villa, and City shell out more than total revenue on players’ salaries.

QPR, who got promoted in 2010/11, spent 183% of revenue on wages.

From this season clubs in European competition must break even.

Penalties for breaking the Uefa rules include a ban from European competitions, fines, the withholding of prize money and transfer bans.

Alan Switzer, director in the sports business group at Deloitte, said: “Chelsea and Manchester City are the clubs which have recorded the biggest losses so they are the two which have the most to do.”

The Star

WALES ONLINE

31st May 2012 By Steve Hughes

THE Premier League has stuck two fingers up at the recession by raking in monster revenues of £2.3billion.

A record 70% of that cash was spent on millionaire players’ wages.

And four clubs in the top division, including champions Manchester City, spent more than 100% of their revenue on their wage bill.

Just five years ago the average wages-to-revenue ratio was around 60%.

The figures, which appear in the latest annual review of football finance by analyst Deloitte, show that players are raking it in more than ever before.

Wages went up by £201million in 2010/11 to almost £1.6bn, a 14% rise.

Overall revenues rose by 12% to £2.27bn.

Manchester United and England striker Wayne Rooney, 26, leads the way in wages, raking in £250,000 a week.

Manchester City stars Yaya Touré, 29, and Carlos Tévez, 28, are not far behind, earning £220,000 and £200,000 a week respectively.

Chelsea’s John Terry, 31, and Frank Lampard, 33, also enjoy massive salaries, trousering weekly pay packets of £150,000 and £140,000.

Despite Rooney’s bumper pay packet, the team with the lowest wages/revenue ratio was Manchester United, who spend 46% of revenue on paying players.

Other top-flight clubs that fall below the 70% mark include Tottenham Hotspur, Newcastle United and Arsenal.

Swansea, QPR, Aston Villa, and City shell out more than total revenue on players’ salaries.

QPR, who got promoted in 2010/11, spent 183% of revenue on wages.

From this season clubs in European competition must break even.

Penalties for breaking the Uefa rules include a ban from European competitions, fines, the withholding of prize money and transfer bans.

Alan Switzer, director in the sports business group at Deloitte, said: “Chelsea and Manchester City are the clubs which have recorded the biggest losses so they are the two which have the most to do.”

The Star

WALES ONLINE

Football finance report underlines Swansea's success

By Rhodri Evans May 30 2012

SWANSEA City had the lowest revenues and wage bill of any of the three clubs promoted to the Premiership in 2011, according to a report published today.

Figures in the 21st Annual Review of Football Finance from the Sports Business Group at Deloitte show Swansea’s revenues for the 2010-11 season of £11.7m were considerably behind those of Queen’s Park Rangers (£16.2m) and Norwich City (£23.4).

Swansea’s 2011 wage bill at £17.4m was also the lowest of the trio, with Norwich spending a little more at £18.4m and Tony Fernandes’ QPR spending a hefty £29.7m.

Swansea’s wage bill doubled on the previous year, increasing by 109% from the £8.3m the club paid its players in the 2009-10 season. However, the significant rise is likely to be due to the bonuses paid out by the club during the promotion winning season. Rivals Norwich paid out £4.4m in such bonuses after they secured promotion.

Perhaps unsurprisingly for a club that has developed a reputation for sound financial management Swansea finished the season with the lowest funds/debt balance of any of the promoted clubs.

Its figure was a mere £754,000 for the 2011 year, far behind that of Norwich (£16.8m) and QPR (£53.9m).

Swansea made a pre-tax loss for the year of £11.2m for the season, although that figure will be far outweighed by the revenues that the club will have received as a result of a successful first season in the Premier League.

At South Wales rivals Cardiff revenues for the year were ahead of Swansea’s at £15.9m, although that figure was 6% down on the previous year.

However almost all of that money was swallowed up in wages, with the Bluebirds’ payroll totalling £15.8m during the year.

Cardiff City did make a £460,000 profit on its transfer activity, but delivered a pre-tax loss for the year of more than £12m. To put that figure in context, there were six other clubs in the Championship which posted a greater loss in the year, the biggest pre-tax loss being that of QPR, which posted a loss of more than £25m. No figures were available for Portsmouth, which entered administration.

Only three Championship clubs made a profit – Leeds Utd, Scun.thorpe and Watford.

Dan Jones, partner in the sports business group at Deloitte said Swansea had performed exceptionally given the club’s wage bill.

“They definitely out-performed and that is testament to the coaching staff,” he said. “Before bonuses they were probably in the bottom half for wages and managed to get promoted, which is a phenomenal achievement.”

He also said that the club’s financial position was very healthy.

“For those of us who can remember them being on the brink of dropping out of the football league it is a great achievement,” he said.

Overall revenue in the Championship increased by £17m (4%) to £423m in the year, prompted by an increase in the parachute payments from the Premier League and the promotion of some larger clubs into the division.

Alan Switzer, director in the sports business group at Deloitte, said: “The Football League’s achievement in attracting fans and growing revenues is often overlooked.

“The Championship is the fourth best attended League in Europe, ahead of the top divisions in Italy and France.

“Whilst Championship revenues have held up well, a wages/revenue ratio of 90%, combined operating losses of £130m and record pre-tax losses of £189m, are a cause for concern.

“It is therefore encouraging that in April 2012 Championship clubs agreed to the implementation of new financial fair play regulations that aim to help clubs reduce the level of annual losses.”

As for the Premier League which Swansea reached as a result of its successful season, the report shows clubs there clubs had a record combined revenue of £2,271m in 2010/11.

Dan Jones, partner in the sports business group at Deloitte, commented: “Top clubs in English football have continued to show impressive revenue growth despite a difficult economic climate.

“Premier League clubs’ revenues increased by 12% in 2010/11, driven by broadcast revenue increasing by 13%, to £1,178m, in the first year of a new three year broadcast cycle.

“This uplift was primarily due to an increase in overseas broadcast deal values, demonstrating once again the Premier League’s unrivalled global popularity.

“Commercial revenue grew by 18% during 2010/11, although this was largely attributable to clubs with a more global profile. Matchday revenue increased by £20m (4%) to £551m, however almost half the clubs suffered a reduction in matchday revenue in 2010/11.”

More than 80% of the Premier League clubs’ revenue increase was spent on wages, which increased by £201m (14%) to almost £1.6bn, and resulted in a record Premier League wages/revenue ratio of 70%.

Adam Bull, consultant in the sports business group at Deloitte, added: “Despite the increase in revenue generated by Premier League clubs, operating profits reduced by £16m (19%) to £68m in 2010/11 and combined pre-tax losses were £380m.

“The challenge for clubs remains converting impressive revenue growth into sustainable profits. This will become even more important for a number of clubs as the financial results for 2011/12 will, for the first time, count towards their UEFA Financial Fair Play break-even calculation.”

BLOOMBERG

Premier League Soccer Teams Boosted By Foreign Broadcast Sales

By Alex Duff - May 30, 2012 7:01 PM ET

The English Premier League was able to use the overseas popularity of its soccer teams to increase clubs’ combined revenue by 12 percent in the season before last amid a sluggish U.K. economy.

Sales at clubs including Manchester United reached 2.27 billion pounds ($3.5 billion), driven by broadcast income from abroad and sponsorship deals for bigger teams, according to research by accountant Deloitte LLP.

Combined pretax losses were 380 million pounds, Deloitte said in a news release, without providing a year-earlier figure, as spending on player transfers surged 38 percent to a record 769 million pounds. While the Premier League is soccer’s biggest championship by sales, Germany’s Bundesliga is more profitable, Deloitte said.

“Top clubs in English football have continued to show impressive revenue growth despite a difficult economic climate,” Dan Jones, a partner in Deloitte’s Sports Business Group, said in the release.

Matchday income rose 4 percent to 551 million pounds, although half of the 20 elite clubs saw ticket revenue fall, Deloitte said.

The combined operating profit of Bundesliga teams rose 24 percent to 154 million pounds for the period, the news release said. That compares with a 19 percent decline to 68 million pounds for the Premier League.

In English soccer’s second-tier Championship, revenue increased 4 percent to 423 million pounds after an increase of so-called solidarity payments to teams relegated from the Premier League and the promotion of larger clubs into the division.

The Championship’s games attract more spectators than matches in Italy’s Serie A and France’s Ligue 1, Deloitte said. Bloomberg

Premier League Soccer Teams Boosted By Foreign Broadcast Sales

By Alex Duff - May 30, 2012 7:01 PM ET

The English Premier League was able to use the overseas popularity of its soccer teams to increase clubs’ combined revenue by 12 percent in the season before last amid a sluggish U.K. economy.

Sales at clubs including Manchester United reached 2.27 billion pounds ($3.5 billion), driven by broadcast income from abroad and sponsorship deals for bigger teams, according to research by accountant Deloitte LLP.

Combined pretax losses were 380 million pounds, Deloitte said in a news release, without providing a year-earlier figure, as spending on player transfers surged 38 percent to a record 769 million pounds. While the Premier League is soccer’s biggest championship by sales, Germany’s Bundesliga is more profitable, Deloitte said.

“Top clubs in English football have continued to show impressive revenue growth despite a difficult economic climate,” Dan Jones, a partner in Deloitte’s Sports Business Group, said in the release.

Matchday income rose 4 percent to 551 million pounds, although half of the 20 elite clubs saw ticket revenue fall, Deloitte said.

The combined operating profit of Bundesliga teams rose 24 percent to 154 million pounds for the period, the news release said. That compares with a 19 percent decline to 68 million pounds for the Premier League.

In English soccer’s second-tier Championship, revenue increased 4 percent to 423 million pounds after an increase of so-called solidarity payments to teams relegated from the Premier League and the promotion of larger clubs into the division.

The Championship’s games attract more spectators than matches in Italy’s Serie A and France’s Ligue 1, Deloitte said. Bloomberg

DELOITTE

Annual Review of Football Finance 2012

Annual Review of Football Finance 2012

New rules, narrow margins

May 2012

Download the foreword (470 KB, PDF)

Download the highlights (66 KB, PDF)

The 21st edition of the Deloitte Annual Review of Football Finance was launched on 31 May 2012. This definitive guide to European football finance provides not only a track record up to the end of the 2010/11 season, but also includes some pointers as to how the industry has developed in 2011/12 and is likely to change in the future.

http://www.deloitte.com/view/en_GB/uk/in....itter_to_arff12

INTRO

Welcome to the 21st edition of the Deloitte Annual Review of Football Finance, in which we analyse and comment on notable financial developments in the world’s most popular sport. In this edition we review recent performance and analyse the current situation in some detail, while looking forward to future prospects.

Unknown pleasures

As the curtain falls on the 20th Premier League season in the most dramatic fashion it is worth considering how far the game has come. In 1991/92 the collective revenue of the 92 Football League clubs was £263m, with the average club in the old Football League Division One generating less than £8m. In 2011/12 the 92 Premier and Football League clubs’ combined revenues were £2.9 billion, with average Premier League club revenues having risen to £114m, nearly 15 times their level 20 years previously.

This spectacular rate of growth reflects the game’s ubiquitous domestic and global profile, the exposure and interest having relentlessly driven revenues. Clubs have transformed their stadia into state-of-the-art venues hosting the world’s greatest players, and appealing to a new and growing fanbase, completing a virtuous circle of growth. There is little doubt that the league is a tremendous success in revenue terms.

This performance has continued through one of the most challenging economic environments in decades, with many supporters seeing a reduction in real incomes as the economy continues to struggle to regain the ground lost during the 2008/09 recession. Football, at the top end in particular, continues to resist these headwinds, as the fundamentals underpinning consumer demand remain strong. Average attendances at Premier League games were close to 35,000 in 2011/12, with capacity utilisation once again comfortably above 90%, while in the Football League total attendances remained above 16m for the eighth consecutive season. BSkyB domestic TV subscriptions now exceed 10m, and the recent Manchester City v Manchester United match attracted a record BSkyB live football audience of over 4m. The consumer appeal

of football remains as strong as ever.

Fools gold

As we have chronicled over the last 20 years, this stellar revenue growth has been accompanied by a corresponding increase in costs, and player wages in particular. Control of player wages, in order to deliver robust and sustainable businesses, continues to be football’s greatest commercial challenge. In recent years there has been an increasing trend for any additional revenue generated to disappear as additional costs, the widely quoted ‘prune juice’ effect.

In the five seasons to 2009/10, the surge in wage costs accounted for 87% of the increase in Premier League club revenue, up from 55% of the increase in revenue in the previous five seasons. 2010/11 marked the start of new Premier League broadcasting deals, which delivered substantial increases in international broadcasting values, and drove a 12% increase in member clubs’ revenues. In an extension of recent trends, over 80% of this additional revenue flowed directly into increased wage costs.

As a result, the Premier League’s key wages to revenue ratio, which had stood at around 60% for most of the 2000s, has risen sharply in recent seasons to exceed 70% for the first time. Despite the revenue boost, the rise in Premier League clubs’ total operating costs exceeded revenue growth, and operating profits fell in the first year of a new broadcasting deal for the first time. Operating margins, which stood at 16% in the Premier League’s opening season, have narrowed to a wafer thin 3%.

With broadcasting revenues likely to deliver limited growth in advance of the next Premier League deal commencing in 2013/14, the focus will be on the clubs themselves to grow revenue in areas directly under their control. Despite a range of potential developments being mooted, Blackpool’s East Stand was the first significant stadium redevelopment at a Premier League ground since the Emirates Stadium opened in 2006, and with clubs naturally focusing on maintaining attendances, rather than maximising revenue, Premier League clubs’ matchday revenues have now remained broadly constant for five seasons.

2

Commercially we have seen some clubs – notably Manchester City and Liverpool in recent months – able to deliver substantially improved deals, but the overall environment remains challenging. It is not unrealistic to foresee a levelling out of Premier League clubs’ revenue in the short term, and potentially even a decline for some clubs in our next couple of editions.

Football League clubs face more immediate challenges, with a significantly reduced broadcast deal from 2012/13 likely to result in a reduction in both Championship and overall league revenues for the first time since the ITV Digital collapse in 2002/03.

Stop me if you think you’ve heard this one before

The more austere economic environment increases pressure for clubs to control costs in response to revenue variations. Football has previously showed an ability to respond to this challenge. Football League clubs did reduce wage costs in 2003/04, but the transition was extremely painful for many clubs and was followed by a swift resumption of steady growth. Similarly, 2004/05 saw Premier League wages fall – albeit minimally – for the only time after Premier League broadcasting deal values fell as a result of limited market competition. Again, this one-off was shortly followed by a return to double digit wage inflation.

Regulation may help some clubs to adjust, with The Football League and the Championship clubs agreeing to implement financial fair play regulations. The new regulations seek to achieve a better balance between revenue and costs and reduce the burden of ongoing funding required from owners or other sources. They include significant penalties for failure to comply in respect of financial results from 2013/14 onwards. For many years the division has struggled financially, as the combination of clubs adjusting to the impact of relegation from the Premier League and others aspirationally attempting to achieve promotion, delivered six seasons of increasing losses. Although financial performance appears to have stabilised, it is at a level where operational expenditure stands 30% above revenues, delivering near-record losses – clearly an unsustainable position. We hope the introduction of the regulations is the catalyst for a long awaited improvement in financial balance.

It is not unrealistic to foresee a levelling out of Premier League clubs’ revenue in the short term, and potentially even a decline for some clubs in our next couple of editions.

Despite the economic contrasts, the Championship remains keenly competitive, with limited correlation between financial outlay and on-pitch performance. Only four of the 15 Premier League clubs relegated in the last five seasons made an immediate return and clubs such as Burnley, Blackpool, Norwich and Swansea have all illustrated that having the largest player budget is not a prerequisite for success.

The Premier League has introduced a range of more interventionist measures in recent years that, together with the introduction of the financial fair play requirements for clubs competing in, or aspiring to compete in, UEFA competitions, should help take some inflationary pressure out of the top end of the player market. We have, however, recently seen a significant increase in ferocity of competition for the UEFA Champions League places among an increasing number of clubs, including a significant investment in playing squads.

Thus clubs are faced with a combination of the introduction of legislation designed to promote more balanced spending and economic headwinds limiting potential revenue growth. In previous years we have seen a trend of operating profitability steadily reducing over the course of broadcast deal durations. If this trend is repeated we could see Premier League operating profits fall to levels comparable with those seen in the league’s infancy, and a majority of Premier League clubs reporting operating losses rather than profits.

Over the years, clubs have sought to utilise various mechanisms including stock market listings, securitisation, bank loans and benefaction to help fund increased expenditure. Perhaps commercial reality, in the form of limited availability of such funding opportunities, may finally bring about a change in behaviour.

Annual Review of Football Finance 2012 Sports Business Group 3

Clubs are faced with a combination of the introduction of legislation designed to promote more balanced spending and economic headwinds limiting potential revenue growth.

Deloitte Annual Review of Football Finance

The sections of this year’s Annual Review cover all the key areas to form an overview of football’s financial situation. In addition to our analysis of trends up to the end of the 2010/11 season, where possible we include pointers to prospective future performance. Europe’s Premier Leagues provides a detailed review of current trends in European football. We then focus on the English situation, with the Revenue and profitability and Club financing sections which form the core of our analysis of the domestic financial situation. Wages and transfers examines the primary area of expenditure for clubs while Stadia development and operations discusses a key area where English clubs continue to maintain a competitive advantage over their European neighbours. Sprinkled within the sections are a number of feature articles, where we discuss and comment on relevant topics and trends in the industry.

The Appendices continue to provide the most comprehensive collection of financial, statistical and reference data available anywhere. It is often said that football is more than a game. In 90 minutes and counting we illustrate this using a snapshot of the wide ranging impact of English football, while in The score we outline some of the key milestones over the lifetime of our analyses.

The Annual Review addresses clubs’ business and commercial performance in financial terms and strives to provide the most comprehensive picture possible of English professional football’s finances. The basis of preparation, and some notes on the limitations of reliance on published financial information, are set out on the inside front cover. Guidelines for interpreting the Appendices are provided on the inside front cover of that document.

A review of this nature cannot provide detailed answers to your football business issues. If a commercial, business, financial, tax or accounting issue arises, we suggest you consult professional advisers. Details for some members of our specialist Sports Business Group are set out on the back cover. All of us are dedicated to full time work in the sports industry and would be delighted to help you.

More detail on our team, services and clients can be found at www.deloitte.co.uk/sportsbusinessgroup

We would like to thank all the clubs who sent us their accounts and, in England, The Football Association, the Premier League and The Football League for their assistance. Outside England thanks are due to the Liga Nazionale Professionisti (‘Lega Calcio’), Deutsche Fußball Liga (‘DFL’), Liga de Fútbol Profesional (‘LFP’), Ligue de Football Professionnel (‘LFP’), Koninklijke Nederlandse Voetbalbond (‘KNVB’), Pro League (Belgium), Österreichischer Fußball-Bund (‘ÖFB’), Svenska Fotbollförbundet (SvFF) and UEFA.

My colleagues, as always, also deserve a huge thank you – the co-authors, named on the inside cover, as well as Henry Wong for his phenomenal support. We all put in a great deal of hard work.

We hope you enjoy this edition.

Dan Jones

Partner, Sports Business Group Deloitte

Annual Review of Football Finance 2012

Annual Review of Football Finance 2012

New rules, narrow margins

May 2012

Download the foreword (470 KB, PDF)

Download the highlights (66 KB, PDF)

The 21st edition of the Deloitte Annual Review of Football Finance was launched on 31 May 2012. This definitive guide to European football finance provides not only a track record up to the end of the 2010/11 season, but also includes some pointers as to how the industry has developed in 2011/12 and is likely to change in the future.

http://www.deloitte.com/view/en_GB/uk/in....itter_to_arff12

INTRO

Welcome to the 21st edition of the Deloitte Annual Review of Football Finance, in which we analyse and comment on notable financial developments in the world’s most popular sport. In this edition we review recent performance and analyse the current situation in some detail, while looking forward to future prospects.

Unknown pleasures

As the curtain falls on the 20th Premier League season in the most dramatic fashion it is worth considering how far the game has come. In 1991/92 the collective revenue of the 92 Football League clubs was £263m, with the average club in the old Football League Division One generating less than £8m. In 2011/12 the 92 Premier and Football League clubs’ combined revenues were £2.9 billion, with average Premier League club revenues having risen to £114m, nearly 15 times their level 20 years previously.

This spectacular rate of growth reflects the game’s ubiquitous domestic and global profile, the exposure and interest having relentlessly driven revenues. Clubs have transformed their stadia into state-of-the-art venues hosting the world’s greatest players, and appealing to a new and growing fanbase, completing a virtuous circle of growth. There is little doubt that the league is a tremendous success in revenue terms.

This performance has continued through one of the most challenging economic environments in decades, with many supporters seeing a reduction in real incomes as the economy continues to struggle to regain the ground lost during the 2008/09 recession. Football, at the top end in particular, continues to resist these headwinds, as the fundamentals underpinning consumer demand remain strong. Average attendances at Premier League games were close to 35,000 in 2011/12, with capacity utilisation once again comfortably above 90%, while in the Football League total attendances remained above 16m for the eighth consecutive season. BSkyB domestic TV subscriptions now exceed 10m, and the recent Manchester City v Manchester United match attracted a record BSkyB live football audience of over 4m. The consumer appeal

of football remains as strong as ever.

Fools gold

As we have chronicled over the last 20 years, this stellar revenue growth has been accompanied by a corresponding increase in costs, and player wages in particular. Control of player wages, in order to deliver robust and sustainable businesses, continues to be football’s greatest commercial challenge. In recent years there has been an increasing trend for any additional revenue generated to disappear as additional costs, the widely quoted ‘prune juice’ effect.

In the five seasons to 2009/10, the surge in wage costs accounted for 87% of the increase in Premier League club revenue, up from 55% of the increase in revenue in the previous five seasons. 2010/11 marked the start of new Premier League broadcasting deals, which delivered substantial increases in international broadcasting values, and drove a 12% increase in member clubs’ revenues. In an extension of recent trends, over 80% of this additional revenue flowed directly into increased wage costs.

As a result, the Premier League’s key wages to revenue ratio, which had stood at around 60% for most of the 2000s, has risen sharply in recent seasons to exceed 70% for the first time. Despite the revenue boost, the rise in Premier League clubs’ total operating costs exceeded revenue growth, and operating profits fell in the first year of a new broadcasting deal for the first time. Operating margins, which stood at 16% in the Premier League’s opening season, have narrowed to a wafer thin 3%.

With broadcasting revenues likely to deliver limited growth in advance of the next Premier League deal commencing in 2013/14, the focus will be on the clubs themselves to grow revenue in areas directly under their control. Despite a range of potential developments being mooted, Blackpool’s East Stand was the first significant stadium redevelopment at a Premier League ground since the Emirates Stadium opened in 2006, and with clubs naturally focusing on maintaining attendances, rather than maximising revenue, Premier League clubs’ matchday revenues have now remained broadly constant for five seasons.

2

Commercially we have seen some clubs – notably Manchester City and Liverpool in recent months – able to deliver substantially improved deals, but the overall environment remains challenging. It is not unrealistic to foresee a levelling out of Premier League clubs’ revenue in the short term, and potentially even a decline for some clubs in our next couple of editions.

Football League clubs face more immediate challenges, with a significantly reduced broadcast deal from 2012/13 likely to result in a reduction in both Championship and overall league revenues for the first time since the ITV Digital collapse in 2002/03.

Stop me if you think you’ve heard this one before

The more austere economic environment increases pressure for clubs to control costs in response to revenue variations. Football has previously showed an ability to respond to this challenge. Football League clubs did reduce wage costs in 2003/04, but the transition was extremely painful for many clubs and was followed by a swift resumption of steady growth. Similarly, 2004/05 saw Premier League wages fall – albeit minimally – for the only time after Premier League broadcasting deal values fell as a result of limited market competition. Again, this one-off was shortly followed by a return to double digit wage inflation.

Regulation may help some clubs to adjust, with The Football League and the Championship clubs agreeing to implement financial fair play regulations. The new regulations seek to achieve a better balance between revenue and costs and reduce the burden of ongoing funding required from owners or other sources. They include significant penalties for failure to comply in respect of financial results from 2013/14 onwards. For many years the division has struggled financially, as the combination of clubs adjusting to the impact of relegation from the Premier League and others aspirationally attempting to achieve promotion, delivered six seasons of increasing losses. Although financial performance appears to have stabilised, it is at a level where operational expenditure stands 30% above revenues, delivering near-record losses – clearly an unsustainable position. We hope the introduction of the regulations is the catalyst for a long awaited improvement in financial balance.

It is not unrealistic to foresee a levelling out of Premier League clubs’ revenue in the short term, and potentially even a decline for some clubs in our next couple of editions.

Despite the economic contrasts, the Championship remains keenly competitive, with limited correlation between financial outlay and on-pitch performance. Only four of the 15 Premier League clubs relegated in the last five seasons made an immediate return and clubs such as Burnley, Blackpool, Norwich and Swansea have all illustrated that having the largest player budget is not a prerequisite for success.

The Premier League has introduced a range of more interventionist measures in recent years that, together with the introduction of the financial fair play requirements for clubs competing in, or aspiring to compete in, UEFA competitions, should help take some inflationary pressure out of the top end of the player market. We have, however, recently seen a significant increase in ferocity of competition for the UEFA Champions League places among an increasing number of clubs, including a significant investment in playing squads.

Thus clubs are faced with a combination of the introduction of legislation designed to promote more balanced spending and economic headwinds limiting potential revenue growth. In previous years we have seen a trend of operating profitability steadily reducing over the course of broadcast deal durations. If this trend is repeated we could see Premier League operating profits fall to levels comparable with those seen in the league’s infancy, and a majority of Premier League clubs reporting operating losses rather than profits.

Over the years, clubs have sought to utilise various mechanisms including stock market listings, securitisation, bank loans and benefaction to help fund increased expenditure. Perhaps commercial reality, in the form of limited availability of such funding opportunities, may finally bring about a change in behaviour.

Annual Review of Football Finance 2012 Sports Business Group 3

Clubs are faced with a combination of the introduction of legislation designed to promote more balanced spending and economic headwinds limiting potential revenue growth.

Deloitte Annual Review of Football Finance

The sections of this year’s Annual Review cover all the key areas to form an overview of football’s financial situation. In addition to our analysis of trends up to the end of the 2010/11 season, where possible we include pointers to prospective future performance. Europe’s Premier Leagues provides a detailed review of current trends in European football. We then focus on the English situation, with the Revenue and profitability and Club financing sections which form the core of our analysis of the domestic financial situation. Wages and transfers examines the primary area of expenditure for clubs while Stadia development and operations discusses a key area where English clubs continue to maintain a competitive advantage over their European neighbours. Sprinkled within the sections are a number of feature articles, where we discuss and comment on relevant topics and trends in the industry.

The Appendices continue to provide the most comprehensive collection of financial, statistical and reference data available anywhere. It is often said that football is more than a game. In 90 minutes and counting we illustrate this using a snapshot of the wide ranging impact of English football, while in The score we outline some of the key milestones over the lifetime of our analyses.

The Annual Review addresses clubs’ business and commercial performance in financial terms and strives to provide the most comprehensive picture possible of English professional football’s finances. The basis of preparation, and some notes on the limitations of reliance on published financial information, are set out on the inside front cover. Guidelines for interpreting the Appendices are provided on the inside front cover of that document.

A review of this nature cannot provide detailed answers to your football business issues. If a commercial, business, financial, tax or accounting issue arises, we suggest you consult professional advisers. Details for some members of our specialist Sports Business Group are set out on the back cover. All of us are dedicated to full time work in the sports industry and would be delighted to help you.

More detail on our team, services and clients can be found at www.deloitte.co.uk/sportsbusinessgroup

We would like to thank all the clubs who sent us their accounts and, in England, The Football Association, the Premier League and The Football League for their assistance. Outside England thanks are due to the Liga Nazionale Professionisti (‘Lega Calcio’), Deutsche Fußball Liga (‘DFL’), Liga de Fútbol Profesional (‘LFP’), Ligue de Football Professionnel (‘LFP’), Koninklijke Nederlandse Voetbalbond (‘KNVB’), Pro League (Belgium), Österreichischer Fußball-Bund (‘ÖFB’), Svenska Fotbollförbundet (SvFF) and UEFA.

My colleagues, as always, also deserve a huge thank you – the co-authors, named on the inside cover, as well as Henry Wong for his phenomenal support. We all put in a great deal of hard work.

We hope you enjoy this edition.

Dan Jones

Partner, Sports Business Group Deloitte

DELOITTE HIGHLIGHTS SECTION

Europe’s premier leagues

• The European football market continued to show resistance to wider economic pressures, growing by 4% to €16.9 billion in 2010/11.

• The ‘big five’ leagues’ revenues grew by 2% to

€8.6 billion, with all but Ligue 1 experiencing growth. Broadcasting revenue was the main driver of growth (up 3%) and now stands at over €4.1 billion, followed by commercial revenue up 5%, and partly offset by a 2% decrease in matchday revenue as clubs adapted pricing strategies to deal with the difficult economic environment.

• The Premier League remains by a distance the highest revenue generating league at €2.5 billion in 2010/11 and recorded the highest revenue growth of any of the ‘big five’ leagues in local currency of 12% (£241m). Further depreciation of Sterling against the Euro meant that the gap to the second highest revenue generating league, the Bundesliga, narrowed slightly to €769m.

• The Bundesliga’s revenue grew 5% to €1,746m. Its clubs lead the way in terms of commercial revenue (€816m) and average attendance (42,100). The additional Champions League spot for Germany from 2012/13 and 50% uplift in domestic league broadcasting rights from 2013/14 will help continue the Bundesliga’s impressive recent revenue growth and will secure its status as the Premier League’s closest rival in revenue terms.

• La Liga revenues grew by 5% to €1,718m. This was again driven by Real Madrid and FC Barcelona, who achieved a combined €93m (11%) increase in revenue. The remaining 18 La Liga clubs suffered a cumulative decrease of €19m (2%). The top two clubs now generate 54% of total La Liga revenue.

• Serie A’s revenues increased by 1% to €1,553m leaving it in fourth place of the ‘big five’ leagues. The return to collective selling of broadcasting rights delivered revenue growth, whilst the distribution model helped balance the revenue more evenly among clubs.

• Ligue 1’s €32m (3%) drop in revenues to €1,040m was largely as a result of weaker Champions League performance by its clubs in 2010/11. Nonetheless, Ligue 1’s revenue is now over €500m less than the fourth highest league, compared to a difference of only €32m 10 years ago. Its total revenues are now closer to Russia in sixth, than Italy in fourth. French clubs need to capitalise on the revenue opportunities through stadium developments being carried out for Euro 2016.

• Football’s greatest business challenge remains cost control. The ‘big five’ leagues’ wages increased by over €104m (2%) to exceed €5.6 billion in 2010/11. Encouragingly this was less than revenue growth and the overall wages/revenue ratio improved. Nonetheless, greater restraint will be required by some clubs in order to comply with UEFA financial fair play regulations.

• Whilst the Premier League has the highest wage costs at €1,771m in 2010/11 (over €600m higher than the next league). Serie A and Ligue 1 have the highest wages to revenue ratios, both at 75%.

• The Premier League and the Bundesliga were the only ‘big five’ leagues to achieve operating profits in 2010/11. The Bundesliga (€171m) substantially increased the gap over the Premier League (€75m). Losses in Ligue 1 decreased marginally to €97m.

• Russia (€614m), Turkey (€515m) and the Netherlands (€431m) are the clear next biggest top tier revenue generating leagues. England’s Football League Championship is the world’s highest revenue generating second tier league, with revenues of €468m.

• In contrast to the majority of the ‘big five’ leagues, commercial revenue is the largest contributor to the majority of non ‘big five’ leagues’ revenues.

The Russian club model is particularly driven by commercial contributions, with Turkey having a much higher broadcasting value (44% of total).

8

Revenue and profitability

• Total revenues of the 92 top professional clubs in English football grew by 9% to £2.9 billion in 2010/11.

• Premier League clubs’ revenues increased by 12% to £2.3 billion, driven by further increases in broadcasting revenue (13%) and impressive growth in commercial revenues (18%).

• Growth in broadcast revenue was primarily due to the higher Premier League distributions following a more than doubling of the amount generated from the sale of overseas broadcast rights, a testament to the Premier League’s global popularity. Premier League clubs’ broadcasting revenue increased to £1,178m in 2010/11, with a staggering compound annual growth rate of 26% since 1991/92.

• The majority of the £83m increase in Premier League clubs’ commercial revenues was driven by the two Manchester clubs and Liverpool. Clubs with stronger global profiles and interest earned significantly more than UK or regionally focused clubs who found market conditions more challenging.

• Total matchday revenue generated by Premier League clubs increased by £20m (4%) to £551m. However, almost half the clubs had a reduction in matchday revenues in 2010/11. The modest increase resulted in matchday revenue becoming the smallest of the three revenue categories for the first time since the start of the Premier League.

• Premier League clubs’ operating profits (£68m) reduced to the lowest level since 1999/2000, when revenue was around a third of the amount generated in 2010/11. Operating margins are now 3%, down from 16% in the Premier League’s inaugural season.

• This aggregated operating figure hides some very contrasting results. Manchester City set a new Premier League record with an £82m loss, whilst their rivals, Manchester United, generated an operating profit greater than £100m for the first time.

• Premier League pre-tax losses reduced marginally to £380m in 2010/11 but are still in need of urgent attention. Only eight clubs recorded pre-tax profits, an improvement from four in 2009/10.

• Championship clubs’ aggregate revenues increased by £17m (4%) to £423m driven by an increase in the solidarity payments made to Championship clubs, but many experienced reductions in matchday and commercial revenue.

• Championship clubs recorded an aggregate operating loss of £130m in 2010/11, only a 1% (£1m) improvement on the record loss recorded in the previous year. Only four Championship clubs made an operating profit. As in 2009/10, 11 clubs lost at least £5m at an operating level and only three clubs reported pre-tax profits.

• The Football League and its member Championship clubs have chosen to implement ‘financial fair play’ regulations with sanctions to be implemented for the first time in respect of the results for the 2013/14 season. It is hoped that these new regulations will reduce clubs’ over-spending, and achieve an improved balance between revenue and costs.

• The top 92 clubs paid almost £1.2 billion in tax in 2010/11, up more than 20% on the previous season, in part due to the first full year of the 50% income tax rate. This significant contribution is often overshadowed by the negative coverage generated by high profile tax investigations into football

club finances.

• Measures continue to be introduced both within the English game and by UEFA to help clubs achieve a better balance between revenues and costs. Given the high levels of revenue clubs generate and the times of austerity they operate in, if they are unable to control their costs accordingly to meet competition regulations, they are unlikely to receive any sympathy from others within or outside football.

Wages and transfers

• Total wages across the Premier League rose by £201m (14%), equivalent to over 80% of the £241m increase in revenue, to almost £1.6 billion. As a result, the league’s wages/revenue ratio reached an all time high of 70%, having been as low as 59% in 2004/05.

• The wages increase was driven by the clubs that finished in the top six positions in 2010/11 and

Annual Review of Football Finance 2012 Sports Business Group 9

Aston Villa (between them £145m increase). The remaining clubs present in the Premier League in both 2009/10 and 2010/11 had more modest average increases of 8%. Every Premier League club increased their wages.

• For the eighth consecutive season Chelsea (£191m) had the highest wages of any club in the Premier League, with Manchester City (£174m) next, £21m greater than the third highest spender Manchester United (£153m).

• 2010/11 exhibited a particularly strong correlation

in the Premier League between league finishing position and a club’s wage ranking, implying that, all other things being equal, spending more on wages translates to on-pitch success.

• Chelsea had the highest wage cost per league point of £2.7m for each of their 71 points, £0.8m per point higher than champions Manchester United. Blackpool had the lowest at £0.6m.

• Championship clubs’ wages grew by 7% (£24m), which was less than their revenue growth of £17m, to £381m and resulted in the wages/revenue ratio returning to 90%. Around a third of clubs in the Championship have wage bills greater than their revenues and hence are heavily reliant on owner funding.

• The correlation between wage costs and league finishing position remains relatively weak in the Championship overall, again illustrating the highly competitive nature of the league.

• Players’ wages across the top 92 professional clubs grew by 4% to exceed £1.4 billion. The average annual gross earnings for a Premier League player in 2010/11 was around £1.4m (equivalent to c.£26,000 per week).

• Total player costs (player wages and net transfers) across the top four divisions rose by 22% to record levels in excess of £1.9 billion in 2010/11, driven in large part by increased transfer spending and wages increase at clubs in the top half of the Premier League. Total player costs for the top 92 top professional clubs overall represented 66% of revenue.

• Gross transfer spending across the 92 top professional clubs increased to £830m (2009/10: £627m). Net transfer payments across the top four divisions totalled a record £485m, an increase of £291m compared with 2009/10, substantially exceeding the previous record of £277m in 2006/07.

• England remains a net importer of players, with £364m (net) leaving the English game to overseas clubs in transfer fees in 2010/11 (2009/10: £114m).

• Total agents fees paid by Premier League and Football League clubs were £89m, representing 11% of the top 92 clubs’ gross transfer expenditure.

• For a third successive season, Manchester City reported over £100m in net transfer expenditure in 2009/10 (£141m). The next highest net spenders were Chelsea (£91m), Manchester United (£70m) and Liverpool (£57m).

• Seven Premier League clubs decreased their net expenditure year on year, emphasising the difference in spending habits and power between clubs in the division.

Stadium development and operations

• Capital expenditure by the top 92 professional clubs totalled £167m in 2010/11, the 14th successive season in which total spending has exceeded £150m.

• Over £3 billion has been invested by the clubs in stadia and facilities over the last 20 years. The spending encompasses in excess of 30 new stadia, numerous impressive stadia redevelopments and investment in state of art training facilities, which the advent of the Premier League’s Elite Player Performance Plan (“EPPP”) may accelerate further.

• The highest expenditure in 2010/11 was the £46m spent by Brighton & Hove Albion on their new stadium which opened in time for the 2011/12 season. The cumulative £98m expenditure in the three years pre opening is one of the largest single investments by any club in the last 20 years. The resulting 172% increase in attendances shows how powerful the ‘new stadium effect’ can be.

10

• Funding major new stadia remains challenging for clubs. Yet despite 2010/11 being the fifth successive year in which no new stadium projects were underway in the Premier League, the top 92 clubs have still invested £570m on stadium and associated facilities over this period, emphasising clubs’ focus on improving their current venues to enhance the matchday experience.

• Clubs continue to respond to the challenges of attracting matchday fans with a variety of ticketing schemes including interest free season ticket payment plans, discounted youth season tickets and more variable pricing for matchday tickets. The average matchday revenue per attendee for Premier League clubs remained at £33.

• The four clubs who competed in the Champions League in 2010/11 generated almost 60% of the £548m in matchday revenue, demonstrating the high levels of ticket demand they enjoy and the higher ticket prices they can command.

• The average attendance for a Premier League match in 2011/12 dropped by 2% to 34,628 due to a mixture of a change in composition of the league and a slight decline in the 17 clubs that competed in both 2010/11 and 2011/12.

• Average capacity utilisation in the Premier League increased to 93% in 2011/12, the 15th consecutive season it has been above 90%.

• Total Football League attendances increased to 16.3m in 2011/12, at an average utilisation of 58%.

• The Championship is the fourth most watched league in Europe.

Club financing

• Premier League clubs’ net debt at summer 2011 of £2.4 billion is about £1 billion lower than at summer 2009 and the lowest level since 2006. This is due to the conversion of owner debt to equity at some clubs and the reduction of net bank borrowings reflecting tougher credit conditions. Whilst the overall level of net debt reduced, around half of the clubs increased their net debt over 2010/11 season.

• Premier League clubs’ net debt at summer 2011 includes £1.5 billion of interest-free ‘soft loans’ from owners (2010: £1 billion), mostly relating to Chelsea (£819m), Newcastle United (£277m) and Fulham (£200m). The majority of the interest-free debt funding from Roman Abramovich since 2003 has been passed down into the football club as equity investment.

• Sheikh Mansour’s reported equity investment into Manchester City has climbed to over £800m in just four seasons, as part of the club’s rapidly progressing transformation strategy in terms of both on-pitch and off-pitch investment.

• Skewed by the cash balances of Arsenal and Manchester United, the Premier League clubs have a positive cash position of £195m at summer 2011 (2010: net bank borrowings of £51m).

• Premier League clubs incurred net interest charges of £102m in 2010/11 (2009/10: £235m); a significant decrease on the previous year largely due to the reductions in net debt in respect of Manchester United (repayment of debt using proceeds of new equity from the owners) and Liverpool (balance sheet transformation following the change of ownership).

• At summer 2011 Premier League clubs had a carrying value of £1.9 billion of tangible fixed assets and £1.2 billion of player registrations on their balance sheets, reflective of the sustained level of investment by clubs in stadia and other facilities and playing talent.

• Championship clubs’ net debt at summer 2011 of £0.7 billion (2010: £0.9 billion) was lower than the previous year largely due to the change in mix of clubs. Around two-thirds of the Championship clubs had net debt in excess of £10m.

• Below the top two divisions managing a club’s financial position is a challenge from one season to the next. Legacy debt issues and the risks taken by some owners will, without correction, inevitably lead to sporadic insolvency cases in the seasons to come.

These highlights are extracted from the relevant sections of the Deloitte Annual Review of Football Finance (May 2012). The basis of the calculations are described in the relevant sections.

Annual Review of Football Finance 2012 Sports Business Group 11

Read more: http://qprreport.proboards.com/index.cgi?board=general&action=display&thread=31755#ixzz1wRBTvGTj

Europe’s premier leagues

• The European football market continued to show resistance to wider economic pressures, growing by 4% to €16.9 billion in 2010/11.

• The ‘big five’ leagues’ revenues grew by 2% to

€8.6 billion, with all but Ligue 1 experiencing growth. Broadcasting revenue was the main driver of growth (up 3%) and now stands at over €4.1 billion, followed by commercial revenue up 5%, and partly offset by a 2% decrease in matchday revenue as clubs adapted pricing strategies to deal with the difficult economic environment.

• The Premier League remains by a distance the highest revenue generating league at €2.5 billion in 2010/11 and recorded the highest revenue growth of any of the ‘big five’ leagues in local currency of 12% (£241m). Further depreciation of Sterling against the Euro meant that the gap to the second highest revenue generating league, the Bundesliga, narrowed slightly to €769m.

• The Bundesliga’s revenue grew 5% to €1,746m. Its clubs lead the way in terms of commercial revenue (€816m) and average attendance (42,100). The additional Champions League spot for Germany from 2012/13 and 50% uplift in domestic league broadcasting rights from 2013/14 will help continue the Bundesliga’s impressive recent revenue growth and will secure its status as the Premier League’s closest rival in revenue terms.

• La Liga revenues grew by 5% to €1,718m. This was again driven by Real Madrid and FC Barcelona, who achieved a combined €93m (11%) increase in revenue. The remaining 18 La Liga clubs suffered a cumulative decrease of €19m (2%). The top two clubs now generate 54% of total La Liga revenue.

• Serie A’s revenues increased by 1% to €1,553m leaving it in fourth place of the ‘big five’ leagues. The return to collective selling of broadcasting rights delivered revenue growth, whilst the distribution model helped balance the revenue more evenly among clubs.

• Ligue 1’s €32m (3%) drop in revenues to €1,040m was largely as a result of weaker Champions League performance by its clubs in 2010/11. Nonetheless, Ligue 1’s revenue is now over €500m less than the fourth highest league, compared to a difference of only €32m 10 years ago. Its total revenues are now closer to Russia in sixth, than Italy in fourth. French clubs need to capitalise on the revenue opportunities through stadium developments being carried out for Euro 2016.

• Football’s greatest business challenge remains cost control. The ‘big five’ leagues’ wages increased by over €104m (2%) to exceed €5.6 billion in 2010/11. Encouragingly this was less than revenue growth and the overall wages/revenue ratio improved. Nonetheless, greater restraint will be required by some clubs in order to comply with UEFA financial fair play regulations.

• Whilst the Premier League has the highest wage costs at €1,771m in 2010/11 (over €600m higher than the next league). Serie A and Ligue 1 have the highest wages to revenue ratios, both at 75%.

• The Premier League and the Bundesliga were the only ‘big five’ leagues to achieve operating profits in 2010/11. The Bundesliga (€171m) substantially increased the gap over the Premier League (€75m). Losses in Ligue 1 decreased marginally to €97m.

• Russia (€614m), Turkey (€515m) and the Netherlands (€431m) are the clear next biggest top tier revenue generating leagues. England’s Football League Championship is the world’s highest revenue generating second tier league, with revenues of €468m.

• In contrast to the majority of the ‘big five’ leagues, commercial revenue is the largest contributor to the majority of non ‘big five’ leagues’ revenues.

The Russian club model is particularly driven by commercial contributions, with Turkey having a much higher broadcasting value (44% of total).

8

Revenue and profitability

• Total revenues of the 92 top professional clubs in English football grew by 9% to £2.9 billion in 2010/11.

• Premier League clubs’ revenues increased by 12% to £2.3 billion, driven by further increases in broadcasting revenue (13%) and impressive growth in commercial revenues (18%).

• Growth in broadcast revenue was primarily due to the higher Premier League distributions following a more than doubling of the amount generated from the sale of overseas broadcast rights, a testament to the Premier League’s global popularity. Premier League clubs’ broadcasting revenue increased to £1,178m in 2010/11, with a staggering compound annual growth rate of 26% since 1991/92.

• The majority of the £83m increase in Premier League clubs’ commercial revenues was driven by the two Manchester clubs and Liverpool. Clubs with stronger global profiles and interest earned significantly more than UK or regionally focused clubs who found market conditions more challenging.

• Total matchday revenue generated by Premier League clubs increased by £20m (4%) to £551m. However, almost half the clubs had a reduction in matchday revenues in 2010/11. The modest increase resulted in matchday revenue becoming the smallest of the three revenue categories for the first time since the start of the Premier League.

• Premier League clubs’ operating profits (£68m) reduced to the lowest level since 1999/2000, when revenue was around a third of the amount generated in 2010/11. Operating margins are now 3%, down from 16% in the Premier League’s inaugural season.

• This aggregated operating figure hides some very contrasting results. Manchester City set a new Premier League record with an £82m loss, whilst their rivals, Manchester United, generated an operating profit greater than £100m for the first time.

• Premier League pre-tax losses reduced marginally to £380m in 2010/11 but are still in need of urgent attention. Only eight clubs recorded pre-tax profits, an improvement from four in 2009/10.

• Championship clubs’ aggregate revenues increased by £17m (4%) to £423m driven by an increase in the solidarity payments made to Championship clubs, but many experienced reductions in matchday and commercial revenue.

• Championship clubs recorded an aggregate operating loss of £130m in 2010/11, only a 1% (£1m) improvement on the record loss recorded in the previous year. Only four Championship clubs made an operating profit. As in 2009/10, 11 clubs lost at least £5m at an operating level and only three clubs reported pre-tax profits.

• The Football League and its member Championship clubs have chosen to implement ‘financial fair play’ regulations with sanctions to be implemented for the first time in respect of the results for the 2013/14 season. It is hoped that these new regulations will reduce clubs’ over-spending, and achieve an improved balance between revenue and costs.

• The top 92 clubs paid almost £1.2 billion in tax in 2010/11, up more than 20% on the previous season, in part due to the first full year of the 50% income tax rate. This significant contribution is often overshadowed by the negative coverage generated by high profile tax investigations into football

club finances.

• Measures continue to be introduced both within the English game and by UEFA to help clubs achieve a better balance between revenues and costs. Given the high levels of revenue clubs generate and the times of austerity they operate in, if they are unable to control their costs accordingly to meet competition regulations, they are unlikely to receive any sympathy from others within or outside football.

Wages and transfers

• Total wages across the Premier League rose by £201m (14%), equivalent to over 80% of the £241m increase in revenue, to almost £1.6 billion. As a result, the league’s wages/revenue ratio reached an all time high of 70%, having been as low as 59% in 2004/05.

• The wages increase was driven by the clubs that finished in the top six positions in 2010/11 and

Annual Review of Football Finance 2012 Sports Business Group 9

Aston Villa (between them £145m increase). The remaining clubs present in the Premier League in both 2009/10 and 2010/11 had more modest average increases of 8%. Every Premier League club increased their wages.

• For the eighth consecutive season Chelsea (£191m) had the highest wages of any club in the Premier League, with Manchester City (£174m) next, £21m greater than the third highest spender Manchester United (£153m).

• 2010/11 exhibited a particularly strong correlation

in the Premier League between league finishing position and a club’s wage ranking, implying that, all other things being equal, spending more on wages translates to on-pitch success.

• Chelsea had the highest wage cost per league point of £2.7m for each of their 71 points, £0.8m per point higher than champions Manchester United. Blackpool had the lowest at £0.6m.

• Championship clubs’ wages grew by 7% (£24m), which was less than their revenue growth of £17m, to £381m and resulted in the wages/revenue ratio returning to 90%. Around a third of clubs in the Championship have wage bills greater than their revenues and hence are heavily reliant on owner funding.

• The correlation between wage costs and league finishing position remains relatively weak in the Championship overall, again illustrating the highly competitive nature of the league.

• Players’ wages across the top 92 professional clubs grew by 4% to exceed £1.4 billion. The average annual gross earnings for a Premier League player in 2010/11 was around £1.4m (equivalent to c.£26,000 per week).

• Total player costs (player wages and net transfers) across the top four divisions rose by 22% to record levels in excess of £1.9 billion in 2010/11, driven in large part by increased transfer spending and wages increase at clubs in the top half of the Premier League. Total player costs for the top 92 top professional clubs overall represented 66% of revenue.

• Gross transfer spending across the 92 top professional clubs increased to £830m (2009/10: £627m). Net transfer payments across the top four divisions totalled a record £485m, an increase of £291m compared with 2009/10, substantially exceeding the previous record of £277m in 2006/07.

• England remains a net importer of players, with £364m (net) leaving the English game to overseas clubs in transfer fees in 2010/11 (2009/10: £114m).

• Total agents fees paid by Premier League and Football League clubs were £89m, representing 11% of the top 92 clubs’ gross transfer expenditure.

• For a third successive season, Manchester City reported over £100m in net transfer expenditure in 2009/10 (£141m). The next highest net spenders were Chelsea (£91m), Manchester United (£70m) and Liverpool (£57m).

• Seven Premier League clubs decreased their net expenditure year on year, emphasising the difference in spending habits and power between clubs in the division.

Stadium development and operations

• Capital expenditure by the top 92 professional clubs totalled £167m in 2010/11, the 14th successive season in which total spending has exceeded £150m.

• Over £3 billion has been invested by the clubs in stadia and facilities over the last 20 years. The spending encompasses in excess of 30 new stadia, numerous impressive stadia redevelopments and investment in state of art training facilities, which the advent of the Premier League’s Elite Player Performance Plan (“EPPP”) may accelerate further.

• The highest expenditure in 2010/11 was the £46m spent by Brighton & Hove Albion on their new stadium which opened in time for the 2011/12 season. The cumulative £98m expenditure in the three years pre opening is one of the largest single investments by any club in the last 20 years. The resulting 172% increase in attendances shows how powerful the ‘new stadium effect’ can be.

10

• Funding major new stadia remains challenging for clubs. Yet despite 2010/11 being the fifth successive year in which no new stadium projects were underway in the Premier League, the top 92 clubs have still invested £570m on stadium and associated facilities over this period, emphasising clubs’ focus on improving their current venues to enhance the matchday experience.

• Clubs continue to respond to the challenges of attracting matchday fans with a variety of ticketing schemes including interest free season ticket payment plans, discounted youth season tickets and more variable pricing for matchday tickets. The average matchday revenue per attendee for Premier League clubs remained at £33.

• The four clubs who competed in the Champions League in 2010/11 generated almost 60% of the £548m in matchday revenue, demonstrating the high levels of ticket demand they enjoy and the higher ticket prices they can command.

• The average attendance for a Premier League match in 2011/12 dropped by 2% to 34,628 due to a mixture of a change in composition of the league and a slight decline in the 17 clubs that competed in both 2010/11 and 2011/12.

• Average capacity utilisation in the Premier League increased to 93% in 2011/12, the 15th consecutive season it has been above 90%.

• Total Football League attendances increased to 16.3m in 2011/12, at an average utilisation of 58%.

• The Championship is the fourth most watched league in Europe.

Club financing

• Premier League clubs’ net debt at summer 2011 of £2.4 billion is about £1 billion lower than at summer 2009 and the lowest level since 2006. This is due to the conversion of owner debt to equity at some clubs and the reduction of net bank borrowings reflecting tougher credit conditions. Whilst the overall level of net debt reduced, around half of the clubs increased their net debt over 2010/11 season.

• Premier League clubs’ net debt at summer 2011 includes £1.5 billion of interest-free ‘soft loans’ from owners (2010: £1 billion), mostly relating to Chelsea (£819m), Newcastle United (£277m) and Fulham (£200m). The majority of the interest-free debt funding from Roman Abramovich since 2003 has been passed down into the football club as equity investment.

• Sheikh Mansour’s reported equity investment into Manchester City has climbed to over £800m in just four seasons, as part of the club’s rapidly progressing transformation strategy in terms of both on-pitch and off-pitch investment.

• Skewed by the cash balances of Arsenal and Manchester United, the Premier League clubs have a positive cash position of £195m at summer 2011 (2010: net bank borrowings of £51m).

• Premier League clubs incurred net interest charges of £102m in 2010/11 (2009/10: £235m); a significant decrease on the previous year largely due to the reductions in net debt in respect of Manchester United (repayment of debt using proceeds of new equity from the owners) and Liverpool (balance sheet transformation following the change of ownership).

• At summer 2011 Premier League clubs had a carrying value of £1.9 billion of tangible fixed assets and £1.2 billion of player registrations on their balance sheets, reflective of the sustained level of investment by clubs in stadia and other facilities and playing talent.